Do you have a place you have been dreaming of visiting—maybe visiting the famous ruins in Mexico or lying on a warm, sunny beach somewhere? What if you could fly now and pay later without using your credit card? Affirm could be the answer.

This post contains affiliate links, which means I may earn compensation from products and services you purchase through my links.

Travellers want to take to the skies again now that some parts of the world have lifted travel restrictions, and who can blame them? But can they afford to?

There have been job changes and uncertainties this past year, so people aren’t even sure they want to spend money travelling. If you have been considering it, there might be an option.

What is Affirm

Affirm is an alternative to credit cards that is becoming quite popular among purchasers. In essence, it is a point-of-sale loan. Max Levchin established the company in 2012; you might recognize him as the co-founder of PayPal.

As of 2020, the company has raised over $1.3 billion from investors.

It was announced in 2020 that Affirm would partner with Shopify, exclusively to provide the buy now, pay later financing option to Shopify merchants in the U.S.

Features of Affirm

Affirm says, ‘Buy Now, Pay Later’ and ‘What you see is what you pay.” There are no hidden fees or sudden surprises. This is good, right? Let’s look at some of the features:

- No hidden fees, no surprises

- No late fees

- No annual fees

- You choose the payment plan that works for you

- No in-depth credit history search so does not affect credit scores

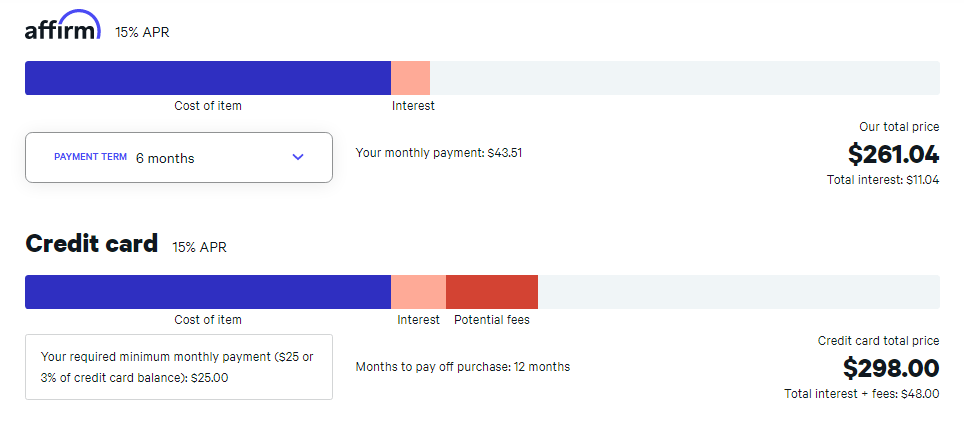

- The annual percentage rate can vary from 0% to 30%, depending on credit and eligibility

- Can be approved for more than one loan at a time

- NOT JUST FOR FLIGHTS!

How Does Affirm Work?

In a sense, it works like a credit card. At checkout, you present your card and choose your preferred payment plan. You are usually approved rather quickly, and you may be requested to make a small down payment upfront and pay the balance according to the payment plan you have chosen.

Your payments can automatically be split into four payments, but since you have the option to choose your payment plan, you could choose 3 months, 6 months, or even 12 months.

Transactions as low as $50 can be eligible for an interest-free biweekly payment plan with no hidden fees or late charges.

Unlike credit cards, interest doesn’t accumulate if you don’t pay off the balance. You always know what your exact end figure is.

How to Shop with Affirm

There are three ways you can fly now and pay later:

- website

- App

- merchant partners

Other Benefits with Affirm

Affirm isn’t just for flights. Is there a favourite pair of shoes you want, or maybe a new set of luggage? There is no limit to what you can purchase through Affirm. At present, they have over 6,000 merchant partners. Sixty-seven percent of Affirm purchases are from repeat users.

No matter if you are looking for clothing, travel, home appliances, or whatever, Affirm works with several thousand merchants and retailers. Some of these popular merchants include Adidas, Walmart, Pottery Barn, Nutribullet, Oscar de la Renta, Audi, Best Buy, Delta Vacations, Peloton, Expedia, and CheapOair.

How to Make Payments to Affirm

You can pay online on their website or through the app. Acceptable payments right now include debit cards, checking accounts, or the old, slow snail mail of sending a check.

How to Process Returns

It is recommended that you contact the store or merchandiser directly. So you are probably wondering if you return an item and how it affects your obligations to Affirm about your loan.

- Affirm could cancel your loan if the return is finalized by the merchant.

- If it is a partial refund or a store credit, you are still responsible for paying off the loan, even though the item was returned.

- Finally, if you are not satisfied with either of the above, you can contact Affirm and submit a dispute. Depending on the outcome, you could either win the dispute and receive a full refund or you could be on the hook to still pay Affirm the full amount if the merchant wins.

Does Fly Now Pay Later Affect Your Credit Score?

Remember, this is a loan, and with most loans, the lending financial institution considers a couple of things, such as a credit check and your payment patterns. Affirm will do a soft credit check, but there is no obligation to buy the product even if you are preapproved, so your credit score won’t be impacted.

Also, your payment patterns won’t be reported to the credit bureau as long as you have four biweekly payments or a 3-month payment term and the loan is 0%.

You can also pay your loan off early to save interest, and you will not be charged a prepayment penalty.

So, what’s the catch?

This is a valid question. You are probably wondering, “If this is so great, how does the company make money?” They get a commission from businesses, partners, and shoppers who pay interest on some items.

Affirm is a third-party lender that works with a merchant who has the products, but the merchant is not the one providing the credit; the merchant pays Affirm a merchant discount rate plus transaction fees, which can vary depending on certain factors.

Customer Service with Affirm

Affirm intends that you have such a great experience that you will return often! They do not want you to buy the items you wish to purchase and incur an unmanageable credit card debt.

However, trying to reach them can be an issue. If you look at the website, there is no way to contact them via phone or email. Their Help Centre is very focused on certain issues, so there is not much room for asking a direct question.

I did a Google search for the phone number by typing in “Contact Affirm by phone,” and this number popped up: 855-423-3729.

I also did the same for an email address, and this one was listed: help@affirm.com. Otherwise, you might have to send them a letter, which could be time-consuming, to the address provided on their website.

Pros and Cons of Affirm

So let’s look at the pros and cons of using Affirm Fly Now Pay Later to book your next flight or make a purchase.

Pros of using Affirm

- No hidden fees

- No late fees or annual fees

- You can make purchases of up to $17,500

- You have the option to choose your payment plan

- No in-depth credit history search so doesn’t affect credit scores

- May be approved for more than one loan at a time

- You can purchase thousands of products

Cons of Using Affirm

- Cannot be used to pay bills

- You might not qualify for a 0% loan; in that case, your annual percentage rate could be 10 to 30% (which could be higher than a credit card payment)

- A down payment could be required for your purchase

- Returns may not go in your favour

- Defaults in payments could be reported to a credit bureau

Final Thoughts

There are some benefits to using Affirm, especially if you need something quickly, for example, a flight for an emergency.

As far as security goes, all personal data is encrypted, so you can provide your information with confidence.

Remember to keep all loans in good standing and pay them off as quickly as you can. This shows the company that you are responsible for paying off the debt, and they are more willing to do business with you again and again.

If you choose the bi-weekly payment option, your eligibility can be checked immediately, and your credit score will not be impacted, nor will you be asked for your social security number.

If you take out too many Affirm loans or default on your payments, you are incurring a financial risk. So while the Buy Now, Pay Later with Affirm option sounds good, you have to be responsible the same as you would be for any loan. Defaulting on a loan could result in a report to the credit bureau (Experian), and you may have difficulty getting further approved loans.

I never used Affirm but I heard about it and many people who talked about it are satisfied. I also wanted to use it for my travels. Unfortunately, I won’t be using it very soon. I live in France and there are so many restrictions to leave the country that I don’t even know if I’ll be able to travel anymore. But Affirm is something that I’ll keep under my thumb…Thanks for your review

Thanks for stopping by :). It is true that so many countries are still under travel restrictions. I have friends who feel the same way you do. Affirm is certainly an option to consider, if and when you are able to travel again.

Hi Mary Ann, We like to, and do travel. When we were young, we traveled across the continent and thankfully had friends along the way that we could stop and visit. Using websites like CheapOAir is a great way to go and getting package deals with flight and hotel accommodations have been a blessing to us. We are eagerly waiting the travel restrictions be lifted so we can get out and travel like we would like. We had a ticket to Europe when the travel restrictions came about over a year ago. We did get a refund. When things open up again we may head across “the pond” again.

Hi Carolyn. Yes, so many are waiting for the restrictions to be lifted. Unfortunately, I fear there will be more restrictions put in place because of the vaccine but that is another story. Where are you located? My friend also had tickets to Europe and had to cancel.

I hope you are able to fly soon and that there will be some great sales for you to take advantage of. Let’s keep hoping :).